Net present worth (NPV) is the distinction between the current worth of money inflows and the current worth of money outpourings throughout some undefined time frame. NPV is utilized in capital planning and speculation wanting to dissect the benefit of a projected venture or task. NPV is the consequence of computations used to track down the ongoing worth of a future stream of instalments using npv calculator.

Everything Net Present Worth Can Say to You

NPV represents the time worth of cash and can be utilized to look at the paces of return of various ventures, or to contrast an extended pace of return and the obstacle rate expected to support a speculation and now we know how to open demat account online.

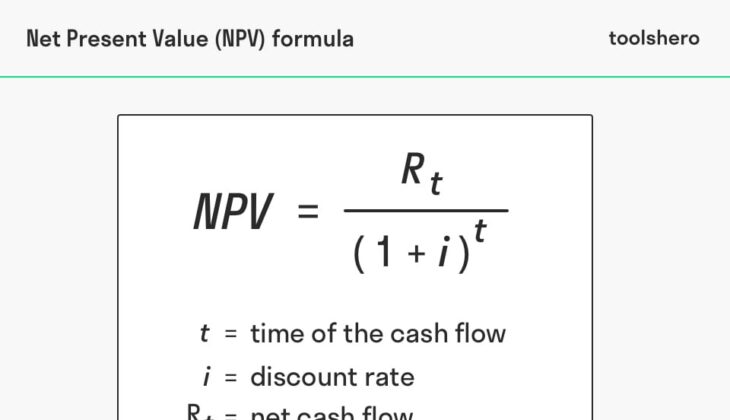

The time worth of cash is addressed in the NPV equation by the rebate rate, which may be an obstacle rate for an undertaking in light of an organization’s expense of capital. Regardless of how the rebate still up in the air, a negative NPV shows that the normal pace of return will miss the mark concerning it, implying that the task won’t make esteem.

With regards to assessing corporate protections, the net present worth estimation is many times called limited income (DCF) examination. It’s the strategy utilized by Warren Buffett to look at the NPV of an organization’s future DCFs with its ongoing cost using npv calculator.

The rebate rate is integral to the recipe. It represents the way that, insofar as financing costs are positive, a dollar today is valued at in excess of a dollar later on. Expansion dissolves the worth of cash over the long haul. In the mean time, the present dollar can be put resources into a protected resource like government securities; speculations more dangerous than Treasurys should offer a higher pace of return. Not entirely settled, the markdown rate is essentially the standard pace of return that a venture should surpass to be advantageous and check how to open demat account online.

For instance, a financial backer could get $100 today or in about a year. Most financial backers might want to defer getting $100 today. Be that as it may, imagine a scenario where a financial backer could decide to get $100 today or $105 in one year. The 5{86b567321bb25cd749b61d53f86e9b99794e156fcea53d99e3c904814cea3e93} pace of return may be advantageous in the event that practically identical ventures of equivalent gamble offered less over a similar period using npv calculator.

If, then again, a financial backer could procure 8{86b567321bb25cd749b61d53f86e9b99794e156fcea53d99e3c904814cea3e93} with no gamble over the course of the following year, then the proposal of $105 in a year wouldn’t do the trick. For this situation, 8{86b567321bb25cd749b61d53f86e9b99794e156fcea53d99e3c904814cea3e93} would be the rebate rate.

Positive NPV versus Negative NPV

A positive NPV shows that the projected profit created by a task or speculation — limited for their current worth — surpass the expected expenses, likewise in the present dollars. It is expected that a venture with a positive NPV will be productive.

A venture with a negative NPV will bring about a total deficit. This idea is the reason for the net present worth rule, which says that main ventures with a positive NPV ought to be thought of how to open demat account online.